Table of Contents

You’ve been lied to.

When you were in school, they told you these different subjects would be vital for your future. But for a lot of us, few really mattered at all.

Think about it…

When was the last time you:

- Looked up a flagpole and wondered how far the distance was from your height to the top of it?

- Had to dissect a frog?

- Measured the length of an isosceles triangle?

This tweet sums it up well:

The school system should have prepared you for life.

More importantly, it should have taught you how to do well financially.

Whether you’re just starting out or decades into your career, money dominates our minds every single day.

It might not be the key to happiness, but without enough of it, we’re miserable. Lack of money is a major stressor, a factor in many divorces, and a reason to envy those who have it.

But don’t worry, my financial advice for young adults is not going to be about frugality. You won’t hear bland advice like “save more money.”

In this post, you’ll learn:

- The secret wealth strategies the rich pass down to their children.

- Why some people keep getting ahead financially while others stay stuck.

- How to make your money work for you instead of letting it become your master.

Stick with me.

And by the end of this post, you’ll have a deeper understanding of personal finance and how to build wealth than most people on the planet.

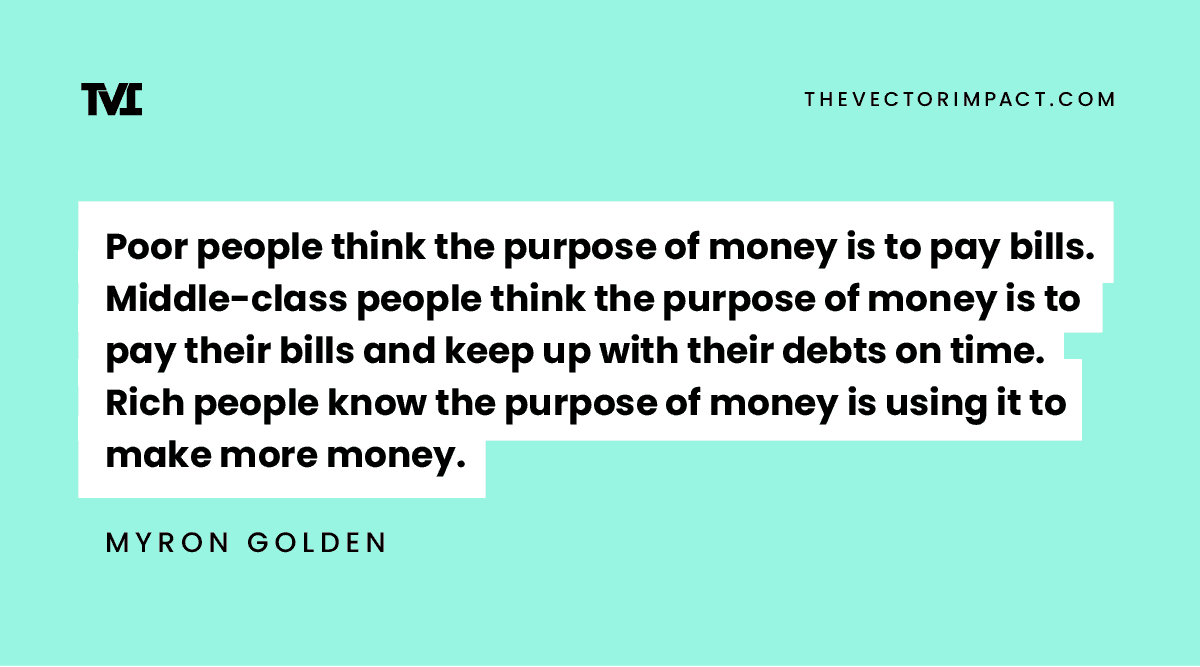

Personal finance tip #1: Rethink the purpose of money

There are several ways you can use your money to make more money:

- You can invest in stocks, bonds, crypto, or real estate.

- You can invest it back into your own business to create leverage by hiring employees, working with contractors, and buying advertising.

- Then there’s this unusual way to use money to make more money. You can use your money to buy back your time and make even more money.

The last one is counterintuitive.

Money isn’t the most valuable commodity. Time is. Wealthy people focus on getting their time back above all else and use their money to do it.

Some examples:

- Hiring people to do certain tasks, like cleaning their apartment

- Using a meal service company or eating takeout every day to avoid having to cook and clean up dishes

- Buying an online course to learn a profitable skill, which shortens their learning curve and decreases the time it takes to learn how to make more money

It’s hard to embrace this type of thinking because it runs counter to how most people live their lives.

Take the never cooking example. For some reason, it hits a deep nerve if you tell people cooking is a waste of time, but think about it this way.

Say your skills are so profitable you value your time at $300/hr.

If you take an hour to cook a meal, eat it, and clean up after yourself, you will have spent one hour that could’ve gone toward making more money, so now you’re at -$300 minus whatever you spent on the food itself—say $10. So you’re now at $-310.

Now, let’s say that you spent more money on food but got your time back. You spend $20 on a meal that’s ready to eat, you get your hour back, and you can use that hour to make money. Now you’re at $280 in profit, even though the pre-prepped meal was more “expensive.”

There are many such cases where poor and middle-class people overvalue saving money instead of thinking about saving time, which, counterintuitively, can help you make more money.

Related:

Personal finance tip #2: Use the rich person’s strategy when buying new things

This next point is similar to the first, but it’s important enough to stand on its own.

Wealthy people buy luxury items with money they get from assets. Middle-class people buy luxury items with income and go into debt to afford them.

Example:

- A corporate worker making $100k a year buys a C-Class Mercedes on a car note that accrues interest.

- A wealthy person receives dividends from stocks they bought, which were purchased with profits in the business. They then use those funds to buy a new car and write it off on their taxes under their LLC.

The first person puts themselves in the hole to get the car.

The second person buys the new car if, and only if, it won’t put a serious dent in their financial situation because they’re using excess profits from passive income to buy their luxuries.

The first person tries to look rich.

The second person is rich.

This is a lesson in delayed gratification. There’s nothing wrong with wanting nice things. But if you’re smart, you’ll acquire them the right way. Like rich people do. Don’t turn yourself into an indentured servant just to buy nice things.

Personal finance tip #3: Don’t let the government eat up all your wealth

Uncle Sam is always going to want a piece.

If you’re not careful, taxes can take a huge chunk of your earnings, especially if you’re a high-income earner.

Say you’re a professional like a doctor or a lawyer. You might make a couple hundred grand a year, but if you’re in the top tax bracket, you’ll lose almost half of your money to income taxes. No bueno.

This is why becoming an entrepreneur and an investor is so powerful. You can benefit from several tax advantages if you’re in business for yourself and put your money to work.

- If you start an LLC, designate it as an S-corp, and pay yourself a salary, you can spend thousands less on FICA taxes (Medicare, Social Security, etc.).

- You can invest up to $22,500 in a 401k, which subtracts from your taxable income, which means you pay less tax.

- In general, if you’re a business owner, you can write off everything you use as part of your business and reduce your taxable income.

- If you own real estate property, you can use a 1031 exchange to sell one property and buy another without paying any taxes on the profit of the sale (as long as you do it in a 45-day window).

- You can “hire” your child as an employee of the business and pay them up to $12,500 each year, which you can subtract from your taxable income.

These are just a few examples of tax loopholes you can use. Learning about taxes is boring, but it makes a huge difference in the amount of money you can keep in a lifetime.

Related:

Personal finance tip #4: Be proactive about financial literacy and understand this counterintuitive math

Pop quiz.

Say you have $1,000.

You put it into an investment account with a 10% annual return.

How long will it take for you to double your money?

The answer: about 7 years.

You can figure this out using the rule of 72. Take the number 72 and divide it by your annual rate of return, and you’ll know how long it will take to double your money.

In general, most people have a poor understanding of how compounding works. And how interest rates work when it comes to debt.

If you have a maxed credit card and you only pay the minimum balance on it, you’ll essentially continue paying that card off forever. By the time you pay it off, you’ll have spent triple or quadruple the amount you owed.

Interest rates, annual returns, debt schedules, and amortization tables are extremely counterintuitive. The best way to learn is by playing around with some online calculators that can show future projections of 1) how your investments will grow and 2) how much money you’ll end up spending based on how fast you pay off your debts.

Here are some you can play around with:

Personal finance tip #5: Shift your money mindset

This last piece of financial advice has less to do with the actions themselves and more with mindset. If you want to become successful financially, you have to think differently than most people do.

You have to change your beliefs about money, what it can do for you, and the role it can play in your life. Most people suffer financially because they have deeply limiting beliefs and negative scripts about money.

Things like:

- A scarcity mindset around money where you clutch every single dollar—instead of focusing on making more money and putting it to work.

- A belief that “money is the root of all evil.” You won’t become wealthy if you don’t believe in ethical wealth creation.

- The notion that the only way to earn money is through a single source of income called a job.

- The idea that you need to be extremely intelligent to make and manage money when you really need the desire to learn, discipline, and the ability to delay your gratification.

- Lastly, the idea that money is super important to begin with. Or that it’s even real. It’s not. We came up with money as a way to exchange goods and services. It feels real, but it isn’t. Once you understand that, you can make a hell of a lot more of it.

Related:

Most financial advice is rooted in scarcity and protecting your money

These personal finance tips are about building wealth.

You are capable of creating a financial situation that alleviates your stress, gives you freedom, and allows you to enjoy the fruits of your success without feeling like you have to trade your life for shackles.

Stop thinking about money in ways that hold you back.

Start thinking like the wealthy and watch your bank account grow like crazy.