Table of Contents

If you want to get through your university years without skipping meals and spending way too much time in your dorm, then you need a college student budget.

A good budget doesn’t limit your financial freedom—quite the opposite. With the right plan in place, you can make the money you have coming in stretch further and discover opportunities to increase your spending (and saving) power over time.

If you’ve never made a budget before, it can be hard to know where to start. This article will provide the best budgeting tips for college students, with resources and step-by-step guides to help you get started right away.

This article is part of our How To Make Money in College series. Be sure to check out the other resources below!

College Saving Guide

Working While in College

Ways To Make Money Online

Ways To Make Money From Home

How To Make Passive Income

Learn How To Pay Off Student Loans

Step #1. Get into the budgeting mindset

Maybe you’re already feeling energized and ready to dive headfirst into building your budget (We see you!). If so, you can skip this step.

But if you’re one of the many people who finds the concept of creating a college student budget anxiety-inducing, or so boring it’s almost impossible, then you may need to shift your mindset before you can begin.

Let’s start by dispelling some common misconceptions about a college student budget:

Myth: Budgeting is only necessary if you’re broke

The reality: It’s true that if you’re running low on funds, a good budget can be a lifesaver. But a budget is equally important if you’re earning steady income—that’s when you have the opportunity to start saving money or putting it toward bigger goals.

Myth: A budget means you have to cut out a lot of the fun stuff

The reality: A budget doesn’t mean you have to eat every meal at home, never go shopping, and cancel all vacations. If your plan doesn’t allow for anything enjoyable, it will fall apart quickly. Instead, you want a budget that is flexible, and tailored to your financial goals, whatever they may be.

Myth: You don’t need a budget until you move off-campus

The reality: Living on-campus can certainly help you save money in the immediate future, since your housing, meals, and utilities tend to be less expensive (and likely included within a flat rate). Because of that cost savings, you can start saving, especially if you’re balancing school and work.

There will come a day when you decide to start living on your own, and having a budget set up before you get to that point will put you miles ahead. Not to mention, if you’ve taken out loans to cover some of your room and board, then starting a college student budget now means you’ll be able to pay off your student loans faster.

➡️ Do your best to flip the switch on all these myths. Once you realize your budget is a path to financial freedom, you’ll be ready to put a plan into action.

Step #2. Get started with this college student budget template

To lay the foundation for your budget, take stock of where you are financially today. We’ve put together this college student budget template to make it easy to keep all this important info in one place.

Got your copy? Great. Now, open it up, and answer the following two questions:

How much money do you have coming in?

First, figure out how much money you have coming into your bank accounts each month. Calculating this depends on your situation:

If you have consistent income…

such as an hourly or salaried job, or a steady side hustle, then simply record the amount you make each month in the box marked “Income (After Tax)” on the college student budget template.

If you have inconsistent income…

then take the average figure from the last six months. You might also find our article on the “feast or famine” phenomenon to be helpful!

If you have no income…

no worries. You can still proceed with the next few steps. When you’re ready, check out a few of these guides for figuring out how to start bringing in some cash.

How much money are you spending each month?

Now that we know how much money we have to play with each month, it’s time to figure out where it’s going right now. This is purely a data-gather exercise—try not to judge your spending habits at this moment, or think too much about how you want to spend your money. Just get the facts from the last few months!

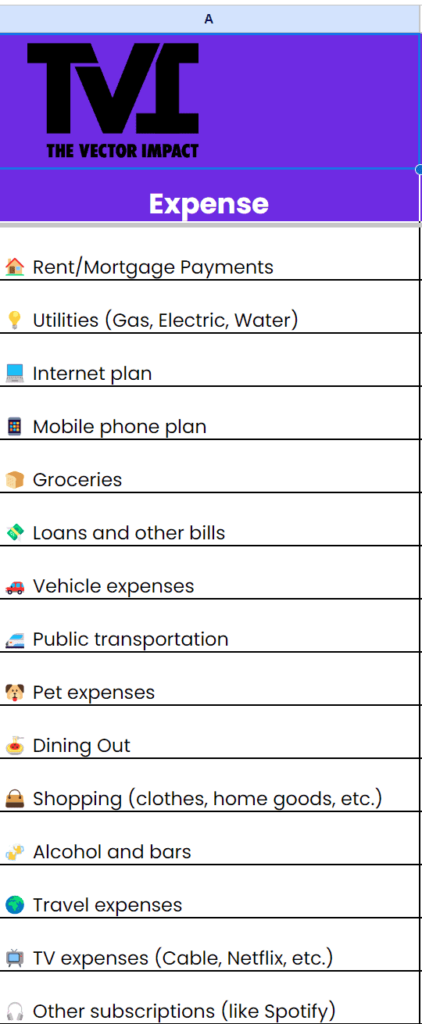

Budgeting for college students can be vastly different depending on where you are on your journey. In our template, we’ve included a wide variety of categories. Feel free to remove or add categories as you see fit.

Fill in as much as you can, using averages over the last few months to get a general idea of your monthly spending as of today.

Step #3. Make predictions for the next three to six months of college

One of the challenges of budgeting as a college student is that your personal circumstances can change significantly month to month. It’s time to look into your crystal ball, and consider what might be in store for you in the near future.

Start by duplicating the tabs on your college budget template, labeling them for the month you’re in now, and the new three to six months coming up.

Then, make your way through each month, adjusting your expected income and expenses as best you can. This doesn’t have to be perfect! Remember, a good budget is flexible, so nothing is set in stone.

Here are some common financial changes college students might experience. Think about these as you work through your future budget:

Changes in housing

Are you moving on or off campus? Living back home with your parents rent-free this summer? Is your landlord raising the rent? Or maybe you’re moving to a place with cheaper rent, but you’ll need extra money for moving trucks in a few weeks.

Changes in income

Maybe you’re planning on quitting your job before school, or your on-campus job starts up in a few weeks. Perhaps you’re launching a side hustle, and expecting your income to increase bit by bit each month. Or you know you’ll sell your car once your job is up, and you’ll have a few extra thousand bucks soon enough.

Paying or saving for tuition

If you’re just starting college, you should begin thinking about how you’ll cover the cost of tuition. If you aren’t sure, you can speak with your college financial advisor to get an idea of how much you’re expected to pay each semester, and see how much is covered by things like grants, scholarships, or loans.

Paying off student loans

Maybe you deferred loans during college, but payments are about to kick in soon after you graduate. Perhaps you want to pay off your student loans faster, or catch up on missed payments to improve your credit.

➡️ By taking all of these financial changes into account, you’ll reduce the chances of unexpected expenses, making it much easier to move toward your financial goals.

Step #4. Set new routines for checking in on your budget

If you’ve made it this far in the article, you now have a good general picture of your current financial situation, and what changes might be coming in the next few months. Phew!

It’s understandable if you need a break from all the numbers and spreadsheets at this point. But managing your college student budget isn’t a one-and-done thing. It’s much easier to manage your money if you make it a routine to check in on how your budget is tracking regularly.

Checking in on your budget can be as simple as setting an hour-long calendar event once a week, so you have time to look at your bank accounts and update your budget template.

You can also consider using a budgeting app like Mint, which makes it easy to get a snapshot of where your money is going.

Whatever method you choose, be consistent. Going more than a week or two without checking in on your budget will make it much harder to achieve your goals!

Step #5. Troubleshoot your college student budget

Whenever you check in on your budget, you should be looking for any hiccups that might interfere with the plan you’re laying out. This is precisely why it’s so beneficial to have a budget in the first place—when the unexpected happens, instead of falling into a financial tailspin, you’ll simply need to pull out your budget and see where you can make adjustments.

Here’s an example: You wake up one morning with a toothache, and end up with an unexpected dentist bill for $500. Before you had a budget, you might have put that expense on a credit card, or put off paying it until loan collectors came knocking, or simply skipped meals until it was paid off.

But now, you can pull out your budget and find ways to make it work. Maybe you reduce your overpayment of student loans for a few months, or take $50 out of each paycheck instead of putting it into savings.

Or if you know you have a tendency to spend $100 on clothing every month, maybe you decide to switch to thrift shopping for the next few months to get the extra cash you need.

Budgeting is a bit like a puzzle—you’ve got all the pieces laid out in front of you, and it’s just a matter of seeing where things fit together.

For more tips on how to stretch a budget further, check out our college savings guide.

Step #6. Set new financial goals for the future

You’ve set a budget, predicted your future finances, and made contingency plans for unexpected changes in your income. What else is there left to do?

Well, now comes the fun part. With more control and insights into your money habits, you can start setting goals for the future. Even if you only have a small amount of money to set aside each month, the sooner you start saving, the faster you’ll get where you want to go.

The key is to set both short- and long-term goals, because how you save your money will depend greatly on how long you have to achieve the goal.

Here are some examples of different goals you might have with your budget:

| Short-Term Goals | Long-Term Goals |

|---|---|

| - Save up for new books - Plan a vacation - Make an extra loan payment - Go on a nice date - Make a big purchase (clothing, tech, etc.) - Take your car to the mechanic - Make a deposit on a new apartment | - Pay off loans early - Save for a down payment on property - Pay off credit card debt - Start a retirement fund - Buy a new or used car - Invest in stocks and bonds |

Once you’ve identified your goals, use some simple calculations to figure out how much you’d need to save to reach the finish line by your desired timeline. Big financial goals are a lot easier to achieve if you can set aside smaller amounts of money slowly over time.

For example, let’s say you estimate you need $1,500 to go on a month-long road trip with friends in six months. That might seem like a big number, but if you can save $300 a month, you’ll meet that goal with some extra spending cash for a special treat on the trip.

Or if you’re interested in paying off your student loans faster, you can use our student loan calculator to figure out how much extra you should be sending to your loan company to get there.

And there you have it! If you’ve followed all six steps, you should now have a good grasp on how to budget as a college student. Eventually, checking in on your budget will become second nature, and you’ll be enjoying a much smoother and more fulfilling college experience.

Happy budgeting!