Table of Contents

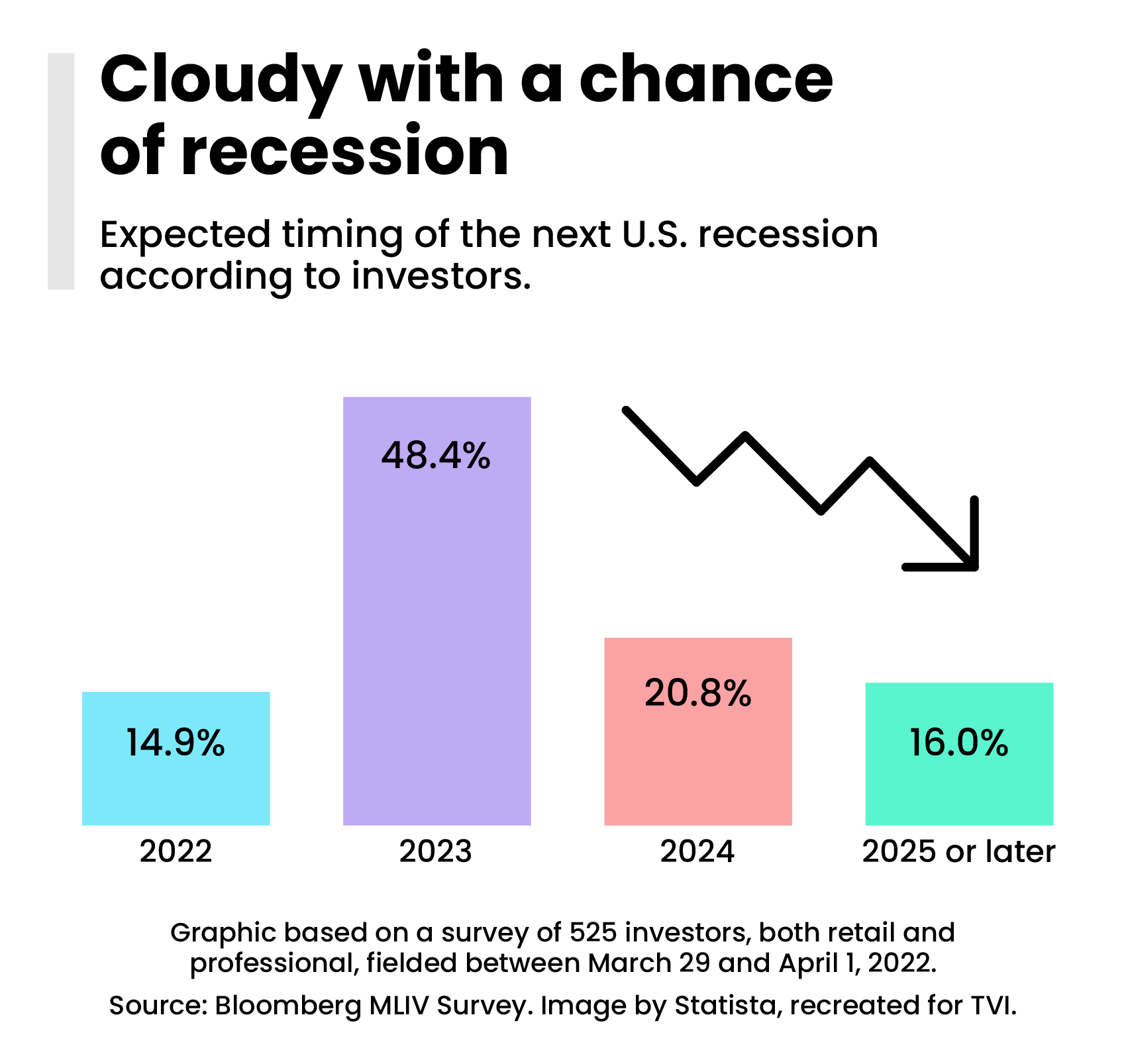

The possibility of a recession is rearing its ugly head yet again. If you’ve been following global and domestic news over the last few years, you’ve been waiting—and hopefully, preparing—for this moment.

If you haven’t, let me clue you in: Things are about to get rough.

Freelancers are anxiously wondering how to raise their rates. Small business owners are gearing up to play the long game to shield their companies from economic fallout. And all are bracing for the downturn.

It seems like a scary inflection point. Yet, experts say that this is the best time to build a recession-proof business and overtake competitors… if you can do it right.

Here’s what you need to know about the likelihood of a global economic recession and steps you can take to increase your business’s resilience.

A brief overview of inflation and the impending recession

A recession is two consecutive quarters of declining gross domestic product. By this definition, we’re walking on some mighty thin ice. A recent estimate by the Bureau of Economic Analysis shows that the United States’ GDP decreased at an annual rate of 1.5 % in the first quarter of 2022.

If we see another contraction in the second quarter, we’re in for it. And given America’s role in the global economy, the rest of the world will certainly see negative impacts as well.

Recessions are marked by a lack of investor confidence in the economy (long-term ventures, especially), reduced consumer spending, and rising prices. How do we know it’s coming? These economic recession indicators are emerging:

- Inverted yield curve*: Short-term U.S. Treasury bonds have higher interest rates than long-term, signaling a lack of confidence in the economy.

- Declines in consumer confidence: Higher prices reduce consumer spending. For example, a recent CNBC and Momentive poll showed that Americans are cutting back on spending, as 76% of adults worry that higher prices will force them to rethink their financial choices in the near future.

- Drop in the Leading Economic Index (LEI): Designed to project economic trends, this recently showed a decrease of 0.3 percent in April.

*This mechanism is driven by bonds and their interest rates. A bond is an agreement that guarantees the repayment of a certain amount of money given to an entity (e.g., government agency, corporation), plus interest. Long-term bonds tend to have higher interest rates because of the higher risk of holding money for an extended period. When the opposite happens, it indicates an oncoming recession.

Inflation, or the rate at which prices rise over a certain period, is one factor pushing the world toward global recession. As supply chains weaken and the cost of living rises, consumers and merchants alike secure a tighter grip on their wallets. This alone can make it much harder to reach and appeal to your consumer base.

Though the situation seems hopeless, there’s a lot you can do to shield your business from the fallout.

Here are five key steps you can take to build a recession-proof business now

1. Adjust your rates

A lot of people hyper-focus on raising their rates—and justifiably so. Higher rates can help absorb rising costs. For solopreneurs, in particular, it’s one of the best defenses against pricey supply chain problems and the rising cost of living.

Still, “raising your rates” is not as simple as many make it sound. First, you need to come up with the numbers, of course. Think about how much you need to earn in a year, then break that down into monthly and weekly earnings goals. From there, price your products or services to meet your monthly, quarterly, and annual targets. Do some market research to compare competitor price points and factor in prospects’ budgets and willingness to pay.

Contextualize your desired rates with your real costs:

- Cost of living

- Personal expenses

- Business expenses

- Retirement savings

- State and federal taxes

- Desired savings capacity

- Add a “value tax”*

*I use the term “value tax” to refer to the monetary value of the conveniences provided by your product or service. For example, if I were selling you accounting software, I might ask you how much you’d be willing to pay to save time and hassle when managing your business’s finances. Ideally, this amount—the WTP—minus the cost of providing the product or service (i.e., material, labor, etc.) is the value tax.

Once you get the numbers down, you’ve got to figure out how to implement the new rates. Many entrepreneurs and freelancers go for a routine four to five percent rate increase once or twice per year. A common method is to write these regular rate increases into your contractual agreements. That way, your clients aren’t blindsided when it comes time to raise the costs.

Alternatives to raising your rates

Raising prices isn’t always the answer. As they gear up for increased production, many small business owners are reassessing their expenditures. Some aim to share the rising cost burdens with their customers instead of passing it on to them through higher price points. Although the latter seems like a universally viable option to some, it may not be for others.

“[There is] the possibility of a decrease in sales due to a reduction in consumer spending. There is also the possibility that we may have to increase our prices to keep up with the rising costs of doing business, which could also turn some of our customers away,” says Lisa Richards, CEO and Creator of the Candida Diet. “Both of these scenarios will leave our business at a disadvantage, owing to the risk of fewer revenue opportunities if [they] materialize.”

Even if you’re not quite in a position to raise your rates, you have options. Think about how you can shave off some costs on your end to keep your income stream running. This is the route Richards will take. They’ve already identified operations “expense holes” while working to be “as financially lean as possible.”

Should you go this route, be careful: Don’t compromise your service and product quality for the sake of cutting costs.

2. Secure a deposit upon order placement or contract signing

Countless freelancers and entrepreneurs are familiar with the notion of living in “feast or famine” cycles. One moment, you’re shattering past records in monthly revenue. The next, you’re dining on cheap ramen and not buying coffee to (barely) pay your bills.

One thing that can exacerbate this cycle is the absence of a deposit or prepayment policy. Now, of course, this depends on your industry and offers. Physical goods are typically paid for before delivery, while many services are compensated when the job’s complete.

And that can be a problem.

Service providers can secure a new client without ever seeing payment for up to 14-30 days. This isn’t ideal for many self-employed professionals or their customers, especially in tough economic times.

Plus, the added squeeze from inflation could push some to cut corners since they don’t have the usual buying power for essential supplies and materials. This inevitably leads to a negative feedback loop that’ll drag your business down if you let it.

Requiring a deposit upon order placement or contract signing helps to ensure that you’re not living paycheck to paycheck. And you’re effectively eliminating the likelihood that your client will cancel the order before completion, thereby strengthening your payment security. People are far less likely to get cold feet on something they’ve already invested in.

3. Maintain an active network

“It’s all about who you know.” People say this a lot about entrepreneurship and rising up the corporate ladder.

Relationships are going to be crucial to your business’s survival throughout the recession. So, don’t overlook the importance of networking! “Networking” can mean getting in touch with industry colleagues on social platforms and at conferences, or interacting with past, inactive clients.

Mingling with the former will help “get your name out there.” Most importantly, you can open up new avenues for referrals. If you reach out to the latter, start slow first. Keep up with them on social media, through a newsletter, or with periodic one-on-one email check-ins. You can ask how business is going, congratulate them for company milestones, or just thank them for their business with some good ol’ customer appreciation.

When you maintain a positive, professional relationship in this way, you’ll be rewarded with chances to re-open dormant accounts as you learn more about their evolving pain points and needs.

Take advantage of the moment to beat competitors

According to the U.S. Small Business Administration, now is an opportune time to gain an edge over competitors. The hard truth is that most people won’t be able to adjust to the coming recession successfully. But businesses that do well in a recession are those that bolster their marketing.

Freelancers are in a unique position: A lot of companies are going to be trimming down their workforces to cut costs in the office. In many cases, this means they’ll be looking to switch to contractors for certain jobs.

That’s what Elliott Davidson, Founder and Director of Parcel Master Solutions Ltd., is planning to do:

“I’m being very cautious around growth in my business and making sure we aren’t being too aggressive and getting ahead of ourselves. More specifically around staff headcount…. We’ll be using short-term contractors for peak time rather than making them full-time employees. This will allow us to scale up and down as we need with a core in-house team.”

At the same time, many business leaders are shifting toward being more results- and performance-focused. Those who center past achievements in their marketing campaigns (e.g., case studies, testimonials) may be at a unique advantage with this group.

That said, freelancers and solopreneurs: You’re now on the radars of eager business owners and talent recruiters. Position yourself wisely.

4. Broaden your sales funnel

Many experts assert that an economic downturn is the best time to invest in your marketing. This is the moment to push sales harder, ensuring that you’re positioned well for the coming recession and building up enough financial padding to soften the fall, no matter how dramatic it may be (or not).

Here are a few ways to broaden and strengthen your sales funnel.

Reposition your brand

There are many different ways to do this, most of which depend on your buyer persona and niche or industry. In general, companies that do well in a recession use their marketing language to reflect their prospects’ reality.

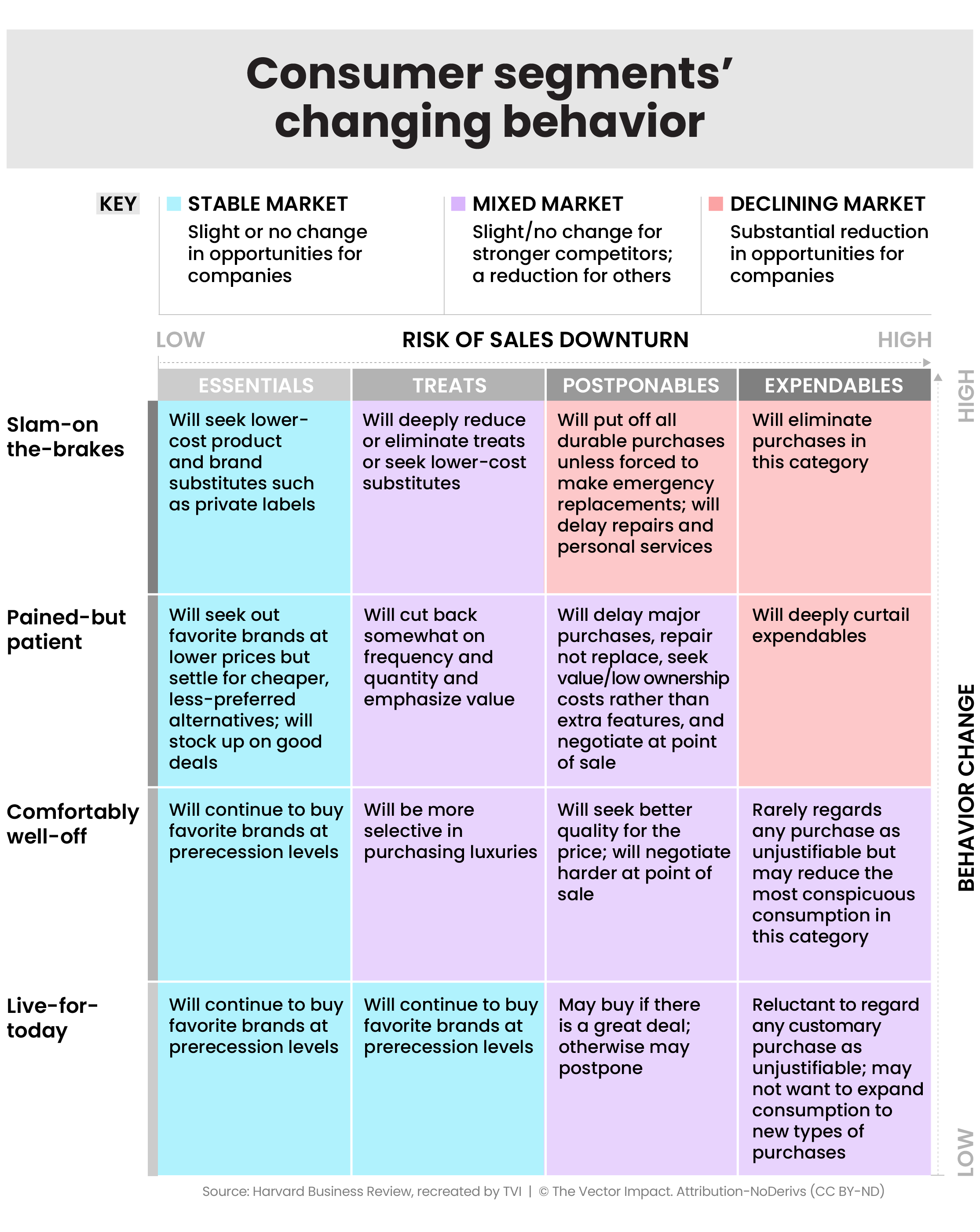

John Quelch and Katherine E. Jocz devised categories to help optimize your positioning during turbulent economic times. These range from highly financially stressed prospects to those who are most insulated from the rising costs. To convert effectively, the language of your offer must connect with each of their unique mindsets.

So, for example, “slam-on-the-breaks” folks will likely be most responsive when you position yourself as “affordable.” On the other hand, “pained but patient” prospects might convert better when your offer is presented as “high value” via small discounts or product bundles.

David Ly Khim, Founder of Omniscient Digital, is wisely positioning the brand as a source of support for clients in the face of economic uncertainty: “Our goal is to make sure our clients view us as partners in marketing and growing the business as we navigate the tough times together as opposed to a cost center.”

Market wisely

A lot of entrepreneurs cut marketing first. That’s the wrong move. Truly “recession-proof” businesses increase and diversify their marketing. This means establishing your presence across multiple channels, pursuing better ad placement to outcompete others in your industry, and sharpening your audience segmentation to reach multiple audience types (e.g., the different spending categories during recession).

Nicky Taveras, owner of DNT Home Buyers, is planning to do exactly that:

“The ability to pivot is important… If home prices are going up significantly in an area where I specialize in, maybe start marketing a different coalition, or change my demographics when it comes to my clients.”

And this applies to more than just real estate. Remember: Not all countries will feel the pinch of recession to the same extent. To reduce the potential damage to your business, consider the strategic pursuit of international leads, if possible.

Expand your market

For example, in the current state of affairs, the U.S., China, and India are poised to endure less negative deviation from their projected 2022 GDP forecasts than the United Kingdom and “Euro Area.” That considered, now’s a good time to start tapping into the global network and generating fresh leads that way.

Sam Speller, Founder of Kenko Matcha, is doing exactly that: “I’m slowly expanding my business into international markets to minimize economic disruptions that may arise from my primary market.”

Through all of this, do not forget your base, especially those who are stuck pinching pennies. Make everyone feel welcome and seen—even if they can’t keep up with the rising costs. Companies that neglect their core customers for the sake of staying afloat will have a hard time reestablishing customer loyalty when the economy returns to normal.

5. Be compassionate to your clients and their budget

Remind yourself that most people are enduring the pressures of inflation, and will soon be subject to the impacts of a global recession. The last thing you want to do is run off your clients and start collecting bad reviews because of insensitivity to this reality.

Find ways to protect your customers’ wallets without undermining yourself or your company. Start thinking about ways that you could potentially improve your customers’ quality of life, particularly by easing their cost burden. Some low-risk options include the introduction of payment plans and value packages, for example.

This means you’ll need to work on your offers and value points. Still, you don’t want to offer prices that are too low. That could damage your business post-recession, as it invites reluctance or resentment in your customers when prices rise again.

Instead, it’s best to approach this strategically and with your real costs in mind by using the rate adjustment guidelines provided in Step 1. That framework will help you home in on your desired earnings, then guide you toward a manageable earnings range for greater flexibility when working with budget-constrained prospects.

Build a recession-proof business, now and forever

No one wants to imagine shrinking revenues for their business. But it’s a natural part of the business cycle, which fluctuates between expansions and contractions in perpetuity.

There will always be times of slow or no growth and influential factors that are entirely out of your control. Preparing for these doesn’t make you pessimistic; it puts you at an advantage. Sure, things are looking pretty grim right now for the global economy. Still, it doesn’t need to spell the end for your business.

By carefully implementing these five steps and checking out the money-management resources below, you can build a business that outlasts your competitors and the coming recession.